More Than 1 Billion Cards are in Circulation, India Adopts Credit

According to reports, the number of credit and debit cards in circulation in India crossed the 1-billion threshold at the end of September 2022, registering a 19% YoY (year-on-year) rise for credit cards and a 2% rise for debit cards compared to September 2021 and showing that Indian consumers are changing their attitudes towards using credit.

At the end of Q3 2022, credit cards in the country amounted to 77.7 million and debit cards were 938.53 million, while the numbers for the end of Q3 2021 were 65 million and 920.3 million respectively.

Registered transaction numbers and volumes during the third quarter of last year were 72.5 crore and ₹3.5 lakh crore respectively for credit cards, and 90.7 crore and ₹1.88 lakh crore respectively for debit cards, showing that credit cards are typically used for larger ticket size transactions.

More recent data shows that the tendency towards using more credit is continuing, and credit cards overhauled debit cards in April 2023 with 25 crore registered transactions against 22 crore. In terms of total value, credit cards contributed ₹1.3 lakh crore, and debit cards – ₹53,000 crore.

Among the factors that have contributed to the rise of credit cards in India are the integration of local RuPay cards into the Unified Payments Interface (UPI) system, recent launches of credit cards by fintech giants such as Paytm and Myntra co-branded with banking institutions, and various incentives offered by banks who want to expand their customer base.

Cards on the Rise in Online Casino Payments As Well

Another recent data source discussing the structure of payments at online casino platforms in South Asia confirms the trend of rising credit and debit card adoption in the whole region.

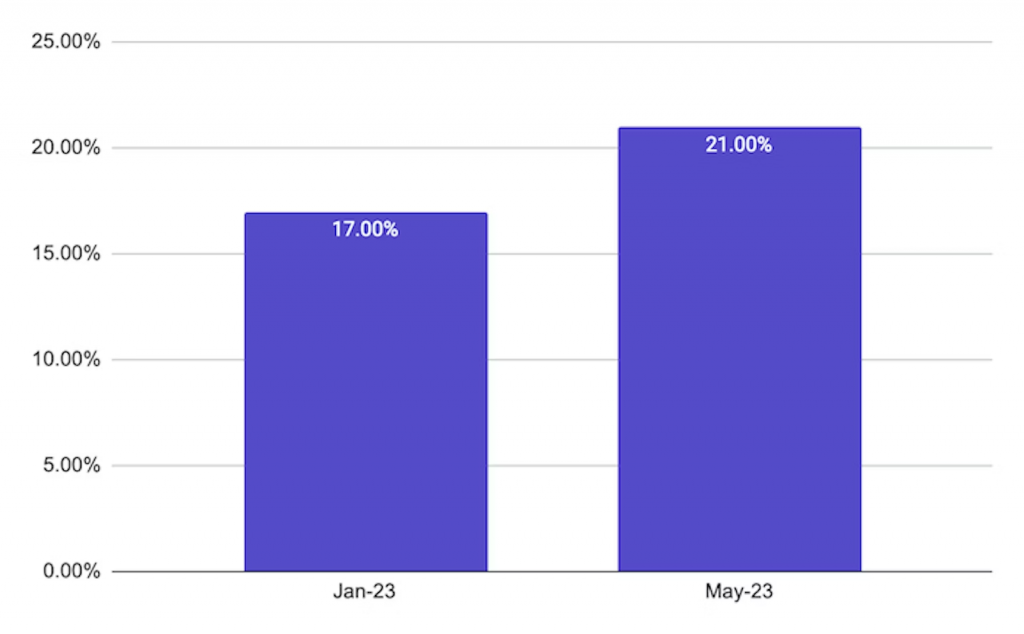

Internal data shared by the Casino Days online casino website on the payment behaviours of players from the region, covering the period from January to May 2023, reveals that credit and debit cards increased their weight by 24% during the course of observation.

In January, 17% of the volume of all real money deposits and withdrawals on Casino Days went through cards, and by May this share had increased to 21%.

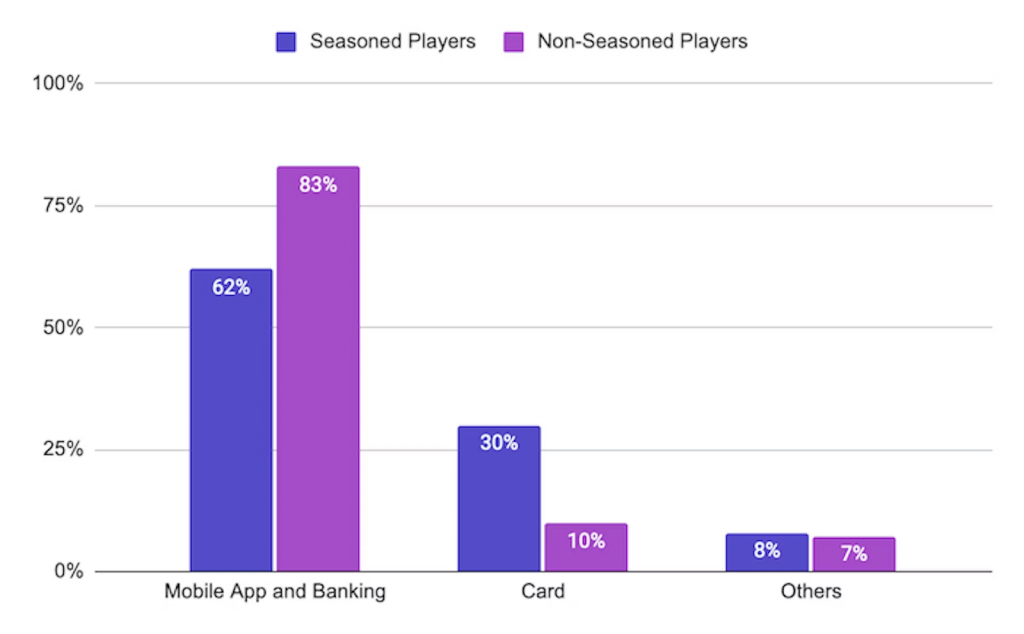

Looking at all payment methods used by South Asian online casino players, transactions based on mobile apps and banking, including global leaders like Google Pay, or regional operators such as PhonePe and PayTM, dominate with a massive share of 87% of all successfully executed payments.

Card payments are second at a great distance with only 8% of the transaction numbers, but they have delivered a substantial 21% share of the transacted monetary volumes for the whole five-month period, while apps carried 71%.

Interestingly, Visa, Mastercard or other card payments are preferred more by seasoned online casino players (30%), while newer gamers display lesser inclination towards using cards (10%).

Crypto Payments Might Soon Change the Picture

Cryptocurrency payments have the smallest weight of transacted volumes of just 1%, coming in fourth place after digital wallets like Skrill and Neteller (carrying 4.9% of transaction numbers and 6.75% of transaction volumes).

At the same time, however, crypto registers the highest success rate (95%) of all used payment methods, and the highest ratio between the number of registered transactions and the transacted volumes of 1 to 10.

Such figures show that crypto currencies are far from reaching their potential in processing online casino deposits and withdrawals.