The value of popular cryptocurrencies Bitcoin and Ethereum have fallen sharply after Wednesday’s crash. This has left people divided as some investors are rushing to offload their holdings while others are in favour of ‘buying the dip’.

Prices of popular cryptocurrencies like Bitcoin, Etherium and DogeCoin have dropped massively in the last 24 hours. At around 6.30 pm today (May 19, 2021), Bitcoin was trading at just Rs 28.5 lakh while Etherium was trading at Rs 1.8 lakh on cryptocurrency platforms. DogeCoin price has fallen to Rs 21 while Shiba Inu coin, which was in the news recently, had dropped by over – 48 per cent to Rs 0.000710.

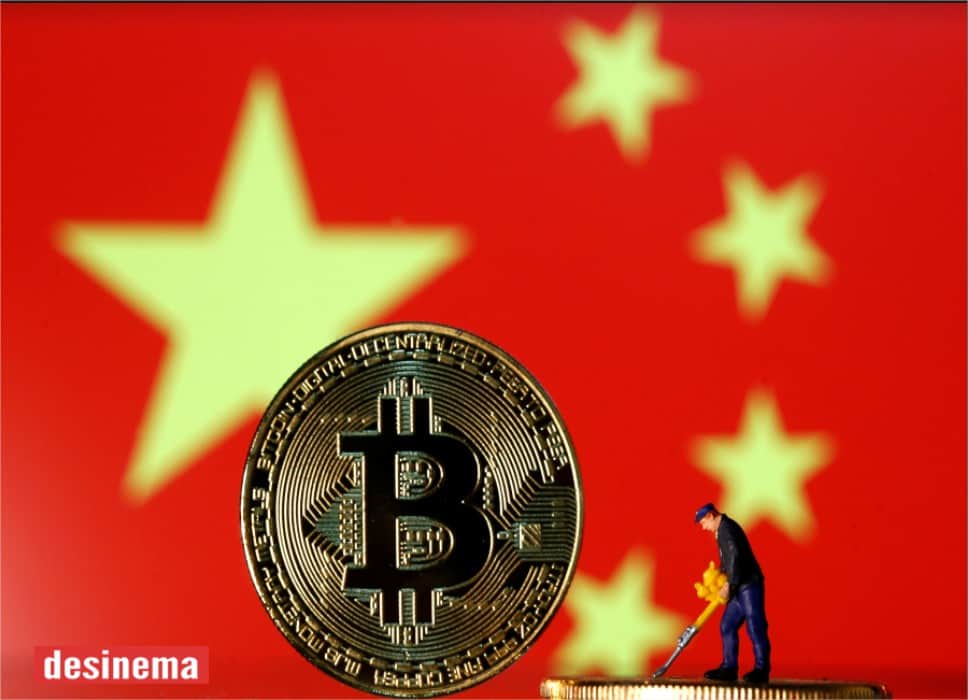

Bitcoin fell to a 3-1/2 month low on Wednesday,after Bitcoin and other major cryptocurrencies slumped after the People’s Bank of China reiterated that the digital tokens cannot be used as a form of payment.Bitcoin has lost about 38% of its value since April 13 when it hit a high of more than $64,800, according to Coindesk.

According to crypto-trading platform Binance, as of 7pm IST Wednesday, Bitcoin the most well-known cryptocurrency —was trading nearly 21% lower than its price 24 hours earlier at $34,693.1. Another popular cryptocurrency Ethereum was down 25% at $2,453.15 while Binance Coin or BNB was down almost 31% at $353.12.

“This is the latest chapter of China tightening the noose around crypto,” said Antoni Trenchev, managing partner and co-founder of Nexo in London, a crypto lender.

Virtual currencies should not and cannot be used in the market because they’re not real currencies, according to a notice posted on PBOC’s official WeChat account. Financial and payments institutions are not allowed to price products or services with virtual currency, the note said.

China has recently taken steps to issue its own digital yuan, seeking to replace cash and maintain control over a payments landscape that has become increasingly dominated by technology companies not regulated like banks.

“It’s no surprise to me, as Chinese capital controls can be challenged by cryptocurrency purchases in the country and transfers out of the country,” said Adam Reynolds, CEO for APAC at Saxo Markets. “So avoiding use of them in the country is essential to maintaining capital controls. The only tolerable digital currency to a government with strong capital controls is their own CBDC.”

What next ?

A crackdown by one of the world’s biggest economy notwithstanding, those in the ecosystem have termed this decline as a short-term correction. “A nearly 40% dip in the bitcoin price from its all-time high looks dramatic but is normal in many volatile markets, including crypto, especially after such a large rally. Such corrections are mainly due to short-term traders taking profits. Long-term value investors might call these lower prices a buying opportunity, as MicroStrategy just did,” Avinash Shekhar, Co-CEO of ZebPay, an India-based crypto exchange, said.

Popular cryptocurrency prices recovered on Thursday after yesterday’s crash. While Bitcoin and Ethereum positions have improved, volatility in the cryptocurrency market remains extremely high. Smaller cryptos are still struggling after Wednesday’s meltdown.